- #Reimbursements staff bookkeeping due to due from how to#

- #Reimbursements staff bookkeeping due to due from software#

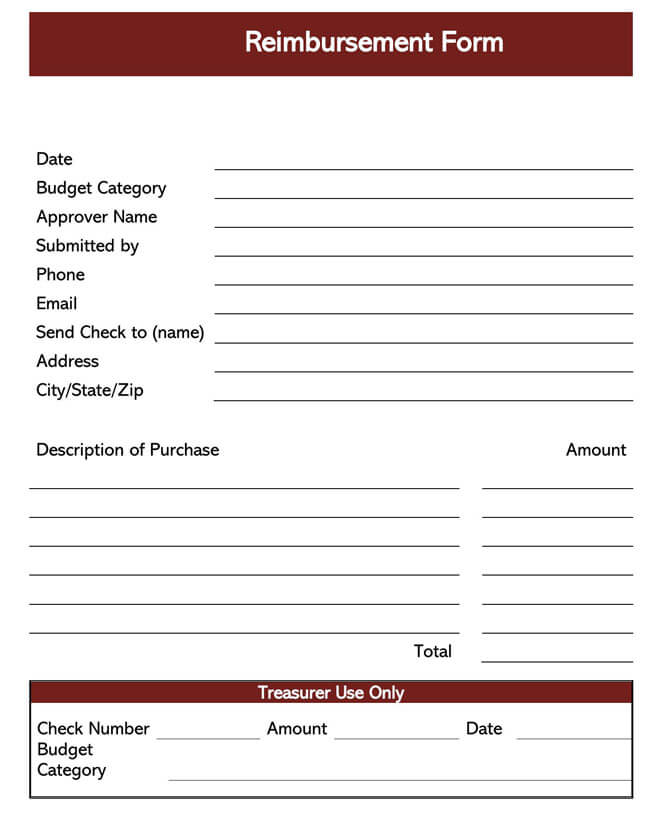

We don't want the reimbursement check to show up under the charitable contributions statement we provide for donations, since this individual is also a donor - we could insert an additional donor identity for this item but it seems counterproductive.

Is there any way to tie the reimbursement check back to the original expense/bill?Ģ) The reimbursement check being invoiced, received, and deposited. I want to make sure this doesn't affect our P&L since the expense wasn't actually part of our budget or expenditures. There seem to be two major parts to this:ġ) The expense being debited: I think I used 'bank fees' as the expense category previously to have a placeholder, since that's how I included a 'bank fees charged to donors' when a check was returned NSF.

#Reimbursements staff bookkeeping due to due from how to#

This has happened a couple of times with different people, and it has always been confusing how to record it. When he arrives at the office, he prepares the supporting invoice to clear advance of 5,000 and reimburse.

#Reimbursements staff bookkeeping due to due from software#

Using an accountant or bookkeeper, or accounting software can help you do your. However, at the end of the week, he had spent up to 6,000 for all expenses. Pay for as many of your work-related expenses as possible through your. She then wrote a personal check and gave it to us for reimbursement of the funds. He had advanced cash 5,000 for the total expense include food and hotel. This will help maintain good financial standing and prevent any potential legal issues. It is important to keep track of the amount due to ensure that bills are paid on time and in full. One of these individuals accidentally pulled out the corporate debit card when paying for lunch and the debit showed up on our bank statement. The amount due to a business or individual is the total of all invoices, expenses, or any other payments that have not yet been paid. That makes sense except the version of Quickbooks Company B uses is an abbreviated version that has limited fields on the write check screen- I can make the check payable to Company A and use Accounts Payable as the account but there isnt anywhere to enter a customer job. Employee achievement awards are tangible personal property awarded to employees because of length of service or achievement. One of the most significant delays in the reimbursement process is when employees dont submit their expenses on time. Our non-profit (church) has a checking account, with debit cards for the few individuals who purchase items for the church's expenses. Employees may receive a gross up tax reimbursement for certain payments (such as spousal travel on business trips) which is also reported on the Form W2.

0 kommentar(er)

0 kommentar(er)